FAST LOANS FOR INVESTORS

Residential Capital Partners offers fast, no-money-down loans from $100,000 to $1,250,000 with loan terms that are completely transparent:

- Single-property residences

- 1 – 4-unit residential properties

- Townhomes and condominiums

- $100,000 – $1,250,000

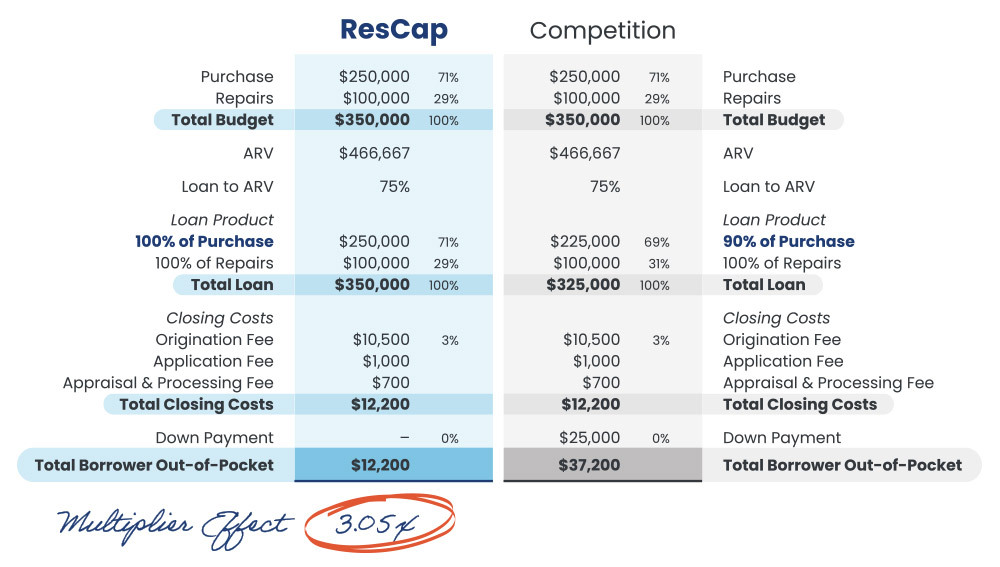

- No money down

- 100% financing up to 65%, 70% or 75% of ARV depending on experience

- 9-month loan term

- No prepayment penalties

We provide fix and flip loans exclusively to business entities—not individual borrowers.

Fast and Easy Loan Process

Apply for Credit

Complete your Credit Application online in as little as 14 minutes by answering a few questions and uploading the required documents.

Submit Property Loan Application – Receive Approval

Once you have been approved for credit and have a property under contract, you will need to complete the Property Loan Application found on our website. After completing the application, you will receive a link to upload all required documents and pay your desktop appraisal invoice.

Close Property Loan

Upon approval our closing team will coordinate with you on next steps. On average, a submitted loan can fund within 14 days of approval.

Post-Closing Services – Repair Draws, Payments and Payoffs

After closing, you will find it quick and easy to manage all your Residential Capital Partner loans using our Online Web Portal.

Your Private Money Lender & Trusted Investment Partner

At Residential Capital Partners, we’re more than just a private money lender—we’re a true partner in your real estate investing journey. Your success is our success, which is why we go beyond funding to provide honest insights, expert guidance, and a lending process designed for investors like you. If a deal doesn’t align with your goals, we’ll tell you—because real partnership means looking out for your best interests, not just closing a loan.

Our fast, transparent, and hassle-free loan process ensures you get the funding you need without the headaches of traditional lenders. With no bait-and-switch tactics, no teaser rates, and no hidden fees, we provide straightforward, reliable fix and flip financing so you can focus on what you do best—closing deals and growing your portfolio.